About US

At Sky Tower Counsel, we’ve seen a concerning trend in traditional financial planning for successful blue-collar families, often focused more on the financial professional’s gain than the family’s needs, leading to “band-aid solutions.”

Our unique approach cuts to the core of financial challenges, integrating tax, estate, and wealth planning to protect and enhance blue-collar businesses and families against economic downturns.

We champion tax reduction through moral, legal, and ethical strategies, empowering our clients as the true heroes of their financial narratives. Join us in a realm where financial goals and ethical values meet, ensuring your wealth grows and remains secure.

SECURE MY FUTURE!

I want to keep my IRA away from the IRS

We promise not to send any unsolicited communications – we will only send you the information you requested.

THE

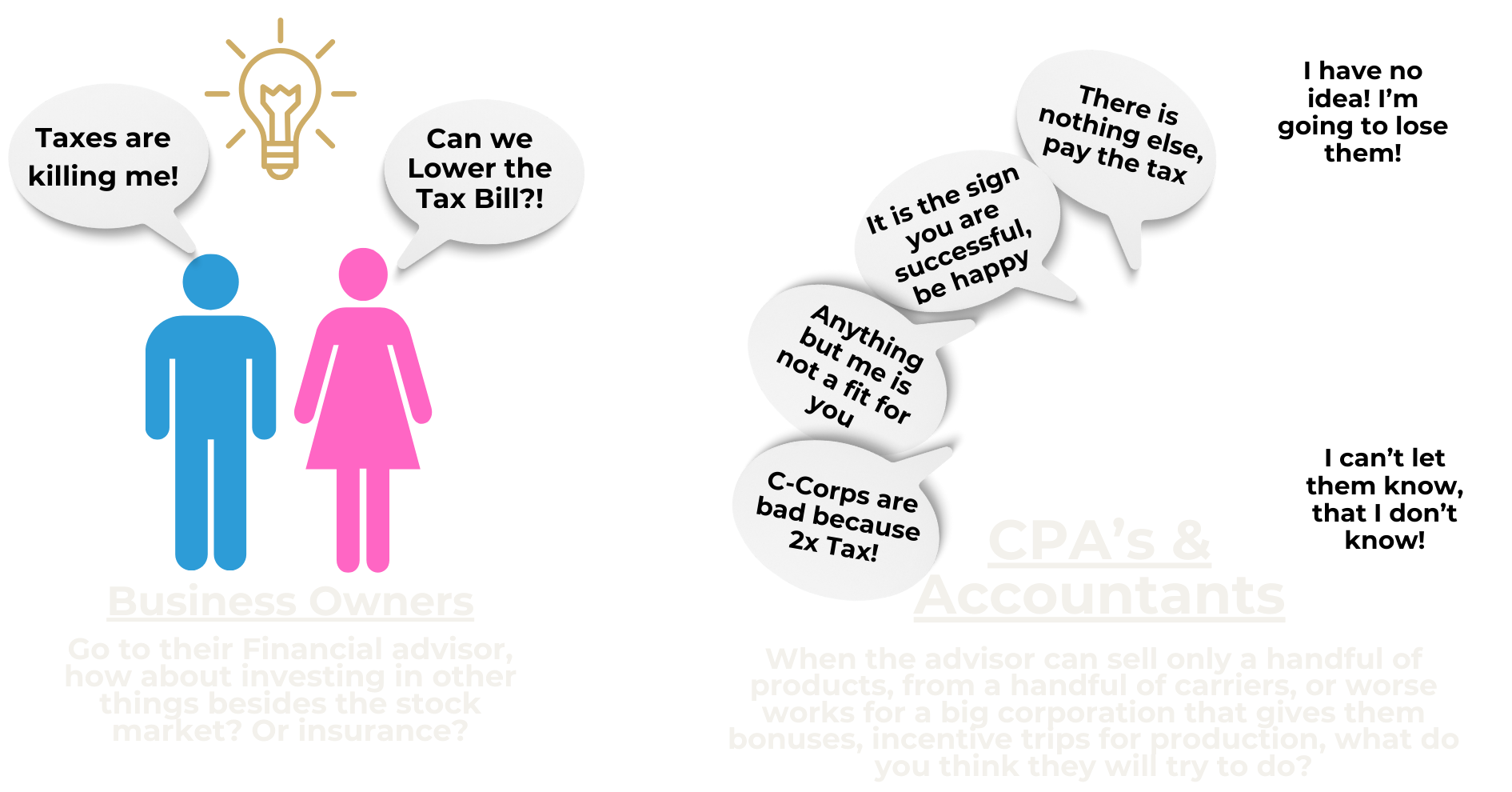

“NO TEAM” PROBLEM

Smart tax planning can make a significant difference in the wealth-building process. It’s not just about minimizing liability; it’s about maximizing opportunities.

— Mark Cuban

Schedule A Consultation

I want to legally keep my taxes away from the IRS

Large organizations, especially in finance and law, prioritize strategies that benefit their bottom line over client interests in tax reduction. This bias often results in clients losing out.

Clients dealing with various professionals often face communication gaps and delays. Sky Tower Counsel believes it’s not the client’s responsibility to handle intricate tax details or perform proactive tax work in their already busy lives.

THE

TEAM

At Sky Tower Counsel, Dallas Richardson leads an exceptional team of 53 specialized team members, each representing a firm dedicated to mastering a distinct facet of the intricate tax code. Our belief is simple yet profound: to truly maximize the tax benefits hidden within the pages of the tax code, we need experts with a mile of depth in their respective areas.

Our team is comprised of industry thought leaders, individuals that have dedicated their careers to becoming the foremost authorities in their specialties. This commitment to specialization sets us apart from the small, local teams of generalists, who often lack the expertise to unearth the myriad tax-saving opportunities available.

The consequences of working with such generalists can be substantial, including overpaying in taxes, miscommunication, limited advice and a lack of proactive, year-round collaboration. At Sky Tower Counsel, our specialized team functions seamlessly as a cohesive unit, ensuring that your unique tax mitigation strategy is meticulously crafted, unbiased, and comprehensive.

Our unwavering dedication to the success of the blue-collar entrepreneur is rooted in our core belief that you deserve to keep more of your money, all while adhering to the highest moral, legal, and ethical standards.

Schedule A Consultation

I want to legally keep my taxes away from the IRS

THE

TAX CODE PROBLEM

The US tax code, with over 80,000 pages, offers valuable insights for blue-collar entrepreneurs, often overlooked by institutions focused on selling products. The author advocates for a more open-minded approach.

Sky Tower Counsel is dedicated to unbiased and comprehensive problem-solving, prioritizing client benefits without compromising ethics. They focus on customized approaches, emphasizing client interests over product sales or asset management.

Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury.

— Learned Hand

Schedule A Consultation

I want to legally keep my taxes away from the IRS

“Advisors give advice in relation to their compensation, and are found on every block. Counselors ask clarifying questions, without a dog in this hunt, that is why we are family wealth counselors.”

OUR

FOCUS

Schedule A Consultation

I want to legally keep my taxes away from the IRS

Client Reviews

-T. Matthews, CFO

“Dallas was at my side through everything. ”

Teagan. R, Commercial Plumbing Contractor

“... no way any local CPA or financial guy can do what they do.”

“There i s no way any local CPA or financial guy can do what they do. When you hop on a zoom meeting and it s you and a dozen experts from all over, there at your table to help me get my family where we always wanted to go…..how can you not value that? There were no big shot corporation guys either they were all down to ear th, made me feel confident, the tax nerds talked, Dallas t rans lated, I got it r ight then and there. I will be here and my kids will too. ”

E. Furtwangler, Commercial Real Estate Developer

“He saves me a fortune every year... ”

“Dallas will show you jus t how much money you have been overpaying on your taxes. Seriously, ask for the bag of money example. You see it when you are writing out the check. But have you actually seen a stack of $500,000 American dollars? He saves me a fortune every year . ”

Blake. S, Contractor

“...every year I get to brag how much he saved me in taxes.”

“Guys on the golf course brag about everything from cars, swings, clubs, real estate, and the new hot secretary. But

everyone knows, I have the best, I found the secret sauce, and every year I get to brag how much he saved me in taxes. Dallas is literally saved in my phone as “the secret sauce.” ”

V. Walker , CEO Cosmetologist

“ ... what will I do with all this money?”

“When working with Dallas , your biggest problem will be, what do I do with all of this money?”

T. Rosenfield, CEO, Manufacturer

“… that hitman looking guy saved

me more than 80% of what would

have been lost to taxes.”

Lawrence. V., Software Developer

“… do yourself a favor and call Dallas”